Understanding How Present Value Works in the Context of Business Valuation

Consider the following scenario: You and a friend are taking in a ballgame one lovely evening at the old ballpark. All is well until that friend of yours mentions that he forgot his wallet. Said friend, then sheepishly asks if he can borrow $50 to fund his consumption of requisite ballpark goodies—a hot dog, a frosty beer, peanuts (what would a ballgame be without peanuts?) and ice cream.

Consider the following scenario: You and a friend are taking in a ballgame one lovely evening at the old ballpark. All is well until that friend of yours mentions that he forgot his wallet. Said friend, then sheepishly asks if he can borrow $50 to fund his consumption of requisite ballpark goodies—a hot dog, a frosty beer, peanuts (what would a ballgame be without peanuts?) and ice cream.

Opting not to lecture your friend about his questionable dietary choices, you fork over the $50 and watch him gorge away as your team finishes out the game.

Soon after, your forgetful friend packs up his belongings and moves out of town. Then, five years later, he suddenly returns, showing up unexpectedly at your front door and reminiscing about that plump hot dog, the bone-chilling beer, the salty peanuts, and the mouth-watering ice cream. To settle this long- awaited debt, your friend finally offers to repay your $50 that was borrowed five years ago. Should you accept this offer?

To help answer this question, we should consider a concept called the Time Value of Money. The basic concept is that a dollar in hand today is worth more than a dollar to be received tomorrow (or five years from tomorrow). A savvy investor will expect a return commensurate with the risk of the investment being made. That same concept is just as readily applicable in determining the value of a business, where the value is frequently equal to the present value of a company’s projected cash flows. In completing such an analysis, one typically considers:

- Inflation – Does the $50 that was lent five years ago have the same purchasing power today?

- Expected rates of return on investments – If you forego spending today and invest (i.e., make a loan to your friend), would you expect a return on your investment?

- Risks associated with making an investment – Would you require a greater return on your investment as the risk of repayment increases?

- The time horizon of an investment – If an investment is made today, would an investor expect the amount invested to be greater in value five years from now? What about 20 years from now?

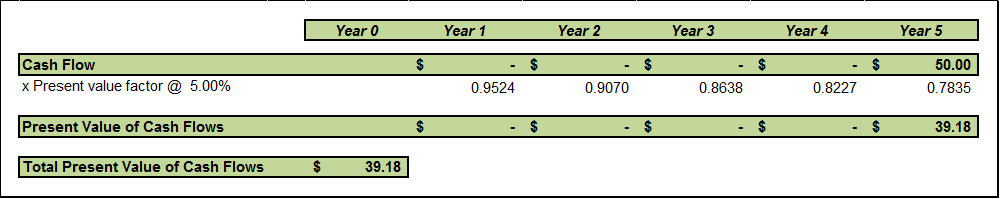

The Time Value of Money in a business valuation enables the valuator to calculate the present value of a company’s projected cash flows by discounting the projected future cash back to the present date. If we go back to our example of loaning $50 to a friend and assume a 5% annual return on our money, we shortchange ourselves by accepting only $50 five years later. A simple example bears this out. Given our 5% desired return, if we lent our friend approximately $40 today, we should expect to receive $50 in return if the payback is five years down the road. Such is the power of the compounding of interest, a concept synonymous with the Time Value of Money.

Summing it all up, the calculation above shows that an investment of $39.18 today would translate to a repayment of $50 after five years based on a 5% rate of return. So if your friend would only offer you $50 after five years, it would be wise to explain this Time Value of Money concept to him/her. The same concept applies to a business valuator projecting the present value of projected future cash flows. A dollar today is worth more than a dollar five years from now. Only after we consider the Time Value of Money will a valuator capture the true value of a business based on its projected future cash flows.

Do you have questions about the Time Value of Money, or any other issues related to valuation? If so, please contact Jessica L. Pagan, CPA at 334-887-7022 or by leaving a message below.