If your business doesn’t already have a retirement plan, it might be a good time to take the plunge. Current retirement plan rules allow for significant tax-deductible contributions.

Don't Have a Tax-Favored Retirement Plan? Set One up Now.

Posted by Marty Williams, CPA on Apr 16, 2024

Posted in Retirement & Wealth Management Planning

Scrupulous Records and Legitimate Business Expenses Are The Key to Less Painful IRS Audits

Posted by Murry Guy, CPA on Apr 11, 2024

If you operate a business, or you’re starting a new one, you know records of income and expenses need to be kept. Specifically, you should carefully record expenses to claim all the tax deductions to which you’re entitled. And you want to make sure you can defend the amounts reported on your tax returns in case you’re ever audited by the IRS.

Posted in Business Advisory

Worker productivity has been in the headlines recently. One reason is the easy access employers have to the many technologies that can monitor employees — from software that tracks when an employee swipes their badge at work to software that notes how long someone is at their computer and what they do while they are there. Another is a certain manifesting distrust of workers, particularly the increased numbers of remote workers. Either way, there's impetus for employers to actively watch what their employees are doing.

Posted in Payroll, HR & Benefits

ESG Audits: Navigating New Frontiers in Corporate Responsibility

Posted by Melissa Motley, CPA on Apr 08, 2024

Reporting on environmental, social, and governance (ESG) matters is an increasingly crucial area of corporate compliance. While ESG reporting and disclosure apply primarily to public companies, there are efforts aimed at requiring private companies to also report on these matters. For example, the European Union’s Corporate Sustainability Reporting Directive requires private organizations that meet specific criteria to publish social and environmental risks and their impacts.

Posted in Audit & Assurance

External auditors spend a lot of time during fieldwork evaluating how businesses report work-in-progress (WIP) inventory. Here’s why this warrants special attention and how auditors evaluate whether WIP estimates seem reasonable.

Posted in Audit & Assurance

“An exemption from UNICAP? And no limitation on the amount of business interest expense I can deduct? Sign me up!”

Posted in Business Tax

Coordinating SEC. 179 Tax Deduction with Bonus Depreciation

Posted by Michael D. Machen, CPA, CVA on Apr 03, 2024

Your business should generally maximize current-year depreciation write-offs for newly acquired assets. Two federal tax breaks can be a big help in achieving this goal: first-year Section 179 depreciation deductions and first-year bonus depreciation deductions. These two deductions can potentially allow businesses to write off some or all of their qualifying asset expenses in Year 1. However, they’re moving targets due to annual inflation adjustments and tax law changes that phase out bonus depreciation. With that in mind, here’s how to coordinate these write-offs for optimal tax-saving results.

Posted in Business Tax

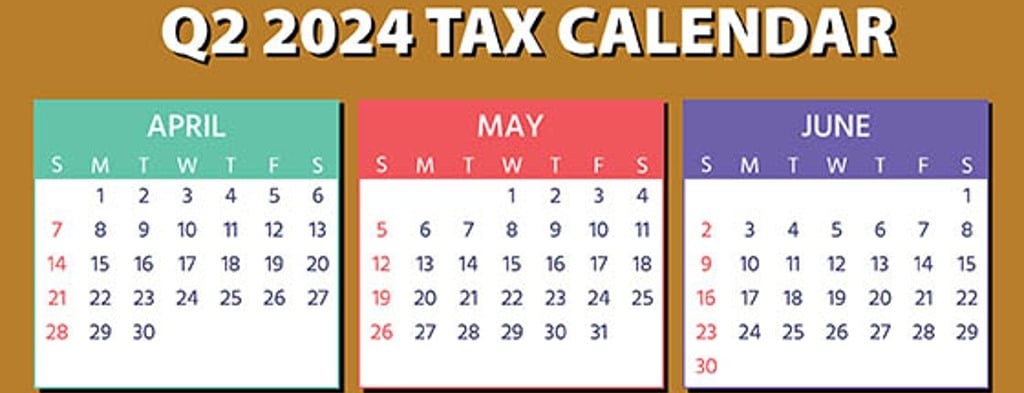

2024 Q2 Tax Calendar: Key Deadlines for Businesses and Employers

Posted by Jessica L. Pagan, CPA on Apr 01, 2024

Here are some of the key tax-related deadlines that apply to businesses and other employers during the second quarter of 2024. Keep in mind that this list isn’t all-inclusive, so there may be additional deadlines that apply to you. Contact us to ensure you’re meeting all applicable deadlines and to learn more about the filing requirements.

Posted in Business Tax

Does Your Business Have Employees Who Get Tips? You May Qualify for a Tax Credit

Posted by Nick Wheeler, CPA on Mar 20, 2024

If you’re an employer with a business where tipping is routine when providing food and beverages, you may qualify for a federal tax credit involving the Social Security and Medicare (FICA) taxes that you pay on your employees’ tip income.

Posted in Business Tax

Treasury, IRS Release Final Regulations on Elective Pay Election for Energy Tax Credits

Posted by Lesley L. Price, CPA on Mar 19, 2024

The Department of the Treasury and the IRS on March 5 released final regulations (TD 9988) on the elective pay election for certain energy tax credits under IRC Section 6417, added by the Inflation Reduction Act (IRA), which treats the credits as a payment against federal income tax liabilities.

Posted in Business Tax