At Machen McChesney, we are committed to Returning Value to you through our monthly e-newsletter, The Value Report.

Here you'll find regular tips to help with your business and personal finances, as well as strategies to grow and more efficiently run your organization.

Table of Content

- Fully Deduct Business Meals This Year

- White House Unveils 2023 Budget Proposal

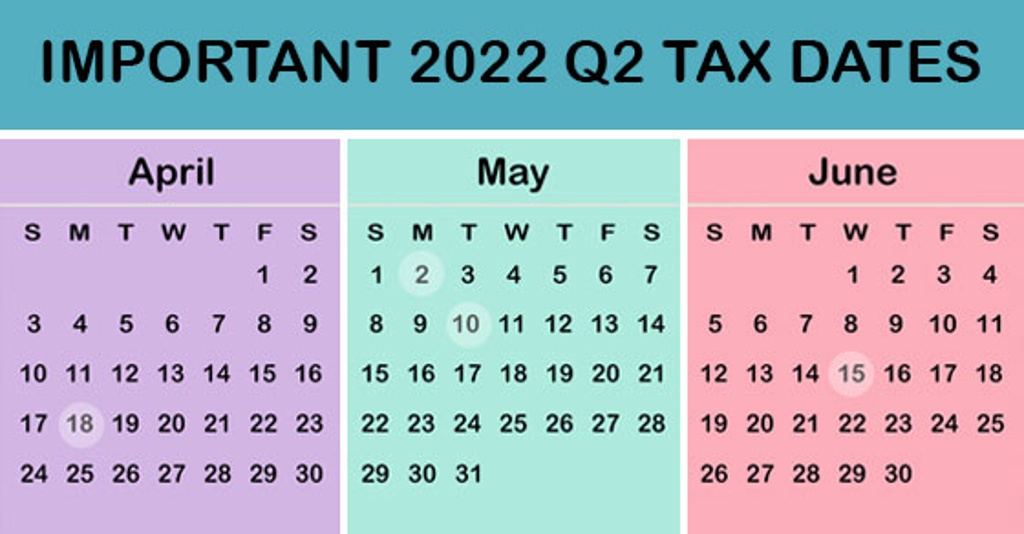

- 2022 Q2 Tax Calendar: Key Deadlines for Businesses and Other Employers

- Tax Breaks for Businesses and Self-Employed Taxpayers

- Tax Considerations When Adding a New Partner at Your Business

- Biden Administration's FY 2023 Budget Plan Calls for Corporate, High-Net-Worth Individuals Tax Hikes

- The Tax Mechanics Involved in the Sale of Trade or Business Property

- Leveraging Internal Audits

- What's New at Machen McChesney

Fully Deduct Business Meals This Year

The federal government is helping to pick up the tab for certain business meals. Under a provision that’s part of one of the COVID-19 relief laws, the usual deduction for 50% of the cost of business meals is doubled to 100% for food and beverages provided by restaurants in 2022 (and 2021). Continue reading.

White House Unveils 2023 Budget Proposal

The Biden administration, on March 28, issued its fiscal year 2023 budget, which would reduce the national deficit by approximately $1 trillion over 10 years primarily by increasing the corporate tax rate to 28% and introducing a minimum tax on billionaires. Continue reading.

2022 Q2 Tax Calendar: Key Deadlines for Businesses and Other Employers

Here are some of the key tax-related deadlines that apply to businesses and other employers during the second quarter of 2022. Keep in mind that this list isn’t all-inclusive, so there may be additional deadlines that apply to you. Contact us to ensure you’re meeting all applicable deadlines and to learn more about the filing requirements. Continue reading.

Tax Considerations When Adding a New Partner at Your Business

Adding a new partner in a partnership has several financial and legal implications. Let’s say you and your partners are planning to admit a new partner. The new partner will acquire a one-third interest in the partnership by making a cash contribution to it. Let’s further assume that your bases in your partnership interests are sufficient so that the decrease in your portions of the partnership’s liabilities because of the new partner’s entry won’t reduce your bases to zero. Continue reading.

Biden Administration's FY 2023 Budget Plan Calls for Corporate, High-Net-Worth Individuals Tax Hikes

The Biden administration’s fiscal year 2023 budget blueprint, released on March 28, consists of a mix of familiar proposals and brand-new initiatives that reflect the President’s policy objectives. The proposals are described in more detail in the General Explanations of the Administration’s Fiscal Year 2023 Revenue Proposals, commonly referred to as the “Green Book,” that was released with the budget, and include the President’s now-familiar calls for increasing the top corporate tax rate to 28% and the top individual rate to 39.6%. Continue reading.

The Tax Mechanics Involved in the Sale of Trade or Business Property

What are the tax consequences of selling property used in your trade or business? Continue reading.

Leveraging Internal Audits

Many companies have an internal audit department that tests whether the organization is accurately reporting financial results and complying with U.S. Generally Accepted Accounting Principles (GAAP). But it’s important for internal auditors to think beyond compliance. Continue reading.

What's New at Machen McChesney?

Sponsorships, new hires, announcements

Continue reading.

We hope you found value in The Value Report you've received this month. We look forward to finding even more ways to Return Value to you in the future.

Please feel free to

visit our website or

visit our blog at any time during the month to interact with additional valuable resources and helpful information.

If you have any questions on the topics above, please feel free to

send us a message.

Thanks,

Machen McChesney