“An exemption from UNICAP? And no limitation on the amount of business interest expense I can deduct? Sign me up!”

Coordinating SEC. 179 Tax Deduction with Bonus Depreciation

Posted by Michael D. Machen, CPA, CVA on Apr 03, 2024

Your business should generally maximize current-year depreciation write-offs for newly acquired assets. Two federal tax breaks can be a big help in achieving this goal: first-year Section 179 depreciation deductions and first-year bonus depreciation deductions. These two deductions can potentially allow businesses to write off some or all of their qualifying asset expenses in Year 1. However, they’re moving targets due to annual inflation adjustments and tax law changes that phase out bonus depreciation. With that in mind, here’s how to coordinate these write-offs for optimal tax-saving results.

Posted in Business Tax

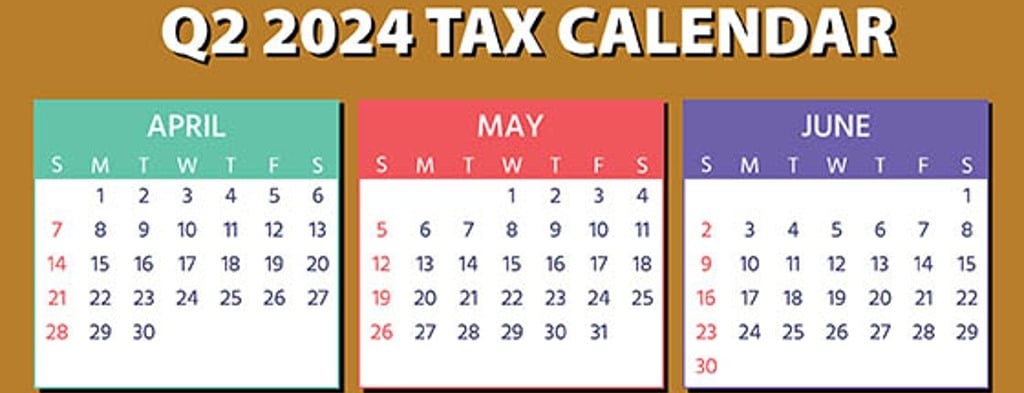

2024 Q2 Tax Calendar: Key Deadlines for Businesses and Employers

Posted by Jessica L. Pagan, CPA on Apr 01, 2024

Here are some of the key tax-related deadlines that apply to businesses and other employers during the second quarter of 2024. Keep in mind that this list isn’t all-inclusive, so there may be additional deadlines that apply to you. Contact us to ensure you’re meeting all applicable deadlines and to learn more about the filing requirements.

Posted in Business Tax

Does Your Business Have Employees Who Get Tips? You May Qualify for a Tax Credit

Posted by Nick Wheeler, CPA on Mar 20, 2024

If you’re an employer with a business where tipping is routine when providing food and beverages, you may qualify for a federal tax credit involving the Social Security and Medicare (FICA) taxes that you pay on your employees’ tip income.

Posted in Business Tax

Treasury, IRS Release Final Regulations on Elective Pay Election for Energy Tax Credits

Posted by Lesley L. Price, CPA on Mar 19, 2024

The Department of the Treasury and the IRS on March 5 released final regulations (TD 9988) on the elective pay election for certain energy tax credits under IRC Section 6417, added by the Inflation Reduction Act (IRA), which treats the credits as a payment against federal income tax liabilities.

Posted in Business Tax

Tax-Wise Ways to Take Cash From Your Corporation While Avoiding Dividend Treatment

Posted by Jessica L. Pagan, CPA on Mar 05, 2024

If you want to withdraw cash from your closely held corporation at a low tax cost, the easiest way is to distribute cash as a dividend. However, a dividend distribution isn’t tax efficient since it’s taxable to you to the extent of your corporation’s “earnings and profits,” but it’s not deductible by the corporation.

Posted in Business Tax

Taking Your Spouse on a Business Trip? Can You Write off the Costs?

Posted by Nick Wheeler, CPA on Feb 21, 2024

A recent report shows that post-pandemic global business travel is going strong. The market reached $665.3 billion in 2022 and is estimated to hit $928.4 billion by 2030, according to a report from Research and Markets. If you own your own company and travel for business, you may wonder whether you can deduct the costs of having your spouse accompany you on trips.

Posted in Business Tax

U.S. House Passes Bipartisan Tax Bill to Provide Business Tax Breaks, Extend Child Tax Credit Enhancements

The U.S. House of Representatives on January 31 passed the Tax Relief for American Families and Workers Act of 2024 (H.R. 7024) by a vote of 357 to 70. The $78 billion bipartisan bill, crafted by Senate Finance Committee Chair Ron Wyden (D-Ore.) and House Ways and Means Committee Chair Jason Smith (R-Mo.), would revive or extend certain business tax incentives and enhance the child tax credit.

Posted in Business Tax

What's the Best Accounting Method Route for Business Tax Purposes?

Posted by Lesley L. Price, CPA on Feb 12, 2024

Businesses basically have two accounting methods to figure their taxable income: cash and accrual. Many businesses have a choice of which method to use for tax purposes. The cash method often provides significant tax benefits for eligible businesses, though some may be better off using the accrual method. Thus, it may be prudent for your business to evaluate its method to ensure that it’s the most advantageous approach.

Posted in Business Tax

Liquidity Overload: Why Having Too Much Cash May Be Bad for Business

Posted by Jessica L. Pagan, CPA on Feb 12, 2024

In today’s uncertain marketplace, many businesses are stashing operating cash in their bank accounts, even though they might not have imminent plans to deploy their reserves. However, excessive “rainy day” funds could be an inefficient use of capital. Here’s a systematic approach to help estimate reasonable cash reserves and maximize your company’s return on long-term financial positions.

Posted in Business Tax