The Tax Cuts and Jobs Act liberalized the rules for depreciating business assets. However, the amounts change every year due to inflation adjustments. And due to high inflation, the adjustments for 2023 were big. Here are the numbers that small business owners need to know.

Jessica L. Pagan, CPA

Recent Posts

A Tax-Smart Way to Develop and Sell Appreciated Land

Posted by Jessica L. Pagan, CPA on Aug 01, 2023

Let’s say you own highly appreciated land that’s now ripe for development. If you subdivide it, develop the resulting parcels, and sell them off for a hefty profit, it could trigger a large tax bill.

Posted in Business Tax

Following the Money: Where Is Real Estate Capital Coming From?

Posted by Jessica L. Pagan, CPA on Jul 14, 2023

The past few years of pandemic recovery, rising inflation and interest rates, and legislative changes have created tremendous shifts and challenging obstacles within the real estate industry. As economic uncertainty applies pressure to sources of traditional capital, the industry is turning to private capital and small and regional banks while managing a decline in government funding.

Posted in Business Advisory

2023 Q3 Tax Calendar: Key Deadlines for Businesses and Other Employers

Posted by Jessica L. Pagan, CPA on Jun 20, 2023

Here are some of the key tax-related deadlines affecting businesses and other employers during the third quarter of 2023. Keep in mind that this list isn’t all-inclusive, so there may be additional deadlines that apply to you. Contact us to ensure you’re meeting all applicable deadlines and to learn more about the filing requirements.

Posted in Business Tax

Working capital — the funds your company has tied up in accounts receivable, accounts payable, and inventory — is a critical performance metric. During times of rising inflation and interest rates, managers search for ways to free up cash and eliminate waste. However, determining the optimal amount of working capital can sometimes be challenging.

Posted in Business Advisory

Take Advantage of the Rehabilitation Tax Credit When Altering or Adding to Business Space

Posted by Jessica L. Pagan, CPA on Apr 19, 2023

If your business occupies substantial space and needs to increase or move from that space in the future, you should keep the rehabilitation tax credit in mind. This is especially true if you favor historic buildings.

Posted in Business Tax

Summer is around the corner, so you may be thinking about hiring young people at your small business. At the same time, you may have children looking to earn extra spending money. You can save family income and payroll taxes by putting your child on the payroll. It’s a win-win!

Posted in Individual Tax

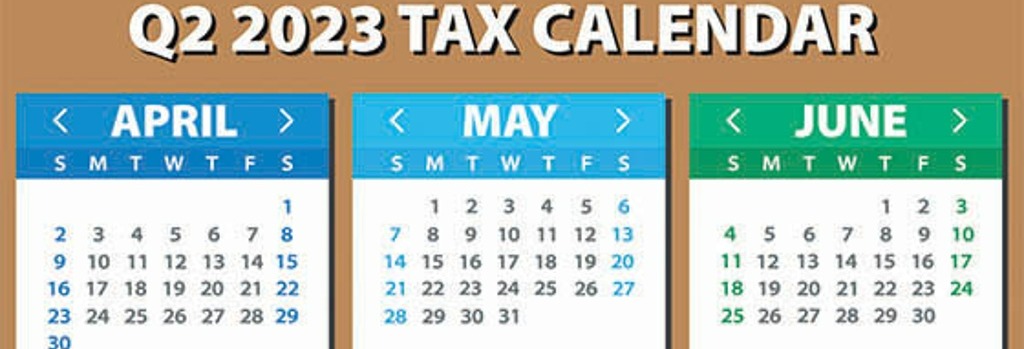

2023 Q2 Tax Calendar: Key Deadlines for Businesses and Other Employers

Posted by Jessica L. Pagan, CPA on Mar 21, 2023

Here are some of the key tax-related deadlines that apply to businesses and other employers during the second quarter of 2023. Keep in mind that this list isn’t all-inclusive, so there may be additional deadlines that apply to you. Contact us to ensure you meet all applicable deadlines and learn more about the filing requirements.

Posted in Business Tax

Protect the "Ordinary and Necessary" Advertising Expenses of Your Business

Posted by Jessica L. Pagan, CPA on Mar 07, 2023

Under tax law, businesses can generally deduct advertising and marketing expenses that help keep existing customers and bring in new ones. This valuable tax deduction can help businesses cut their taxes.

Posted in Business Tax

Inflation Reduction Act: Costs and Benefits for Real Estate & Construction

Posted by Jessica L. Pagan, CPA on Feb 17, 2023

The Inflation Reduction Act's (IRA's) expansion of key energy efficiency tax incentives – such as the 179D energy efficient commercial buildings deduction and the 45L new energy efficient home credit – is anticipated to have a significant impact on real estate and construction industry. The legislation could provide a significant financial boost for firms looking to utilize environmentally conscious building materials and practices, potentially ushering in a new wave of progress in clean energy construction.

Posted in Business Tax